FC Exchange is a leading currency provider offering bespoke international money transfers for each client’s individual needs. They offer a Best Exchange Rate Guarantee to give their customers exchange rates up to 4% more competitive than other providers. Also, they are FCA approved to transfer your funds safely and quickly – wherever you are in the world. FC Exchange’s specialist knowledge of the currency market and plethora of emigration experience has enabled thousands of clients to relocate to the USA and save thousands in the process.

FC Exchange is a leading currency provider offering bespoke international money transfers for each client’s individual needs. They offer a Best Exchange Rate Guarantee to give their customers exchange rates up to 4% more competitive than other providers. Also, they are FCA approved to transfer your funds safely and quickly – wherever you are in the world. FC Exchange’s specialist knowledge of the currency market and plethora of emigration experience has enabled thousands of clients to relocate to the USA and save thousands in the process.

How can currency specialists like FC Exchange save clients money?

- A Best Exchange Rate Guarantee

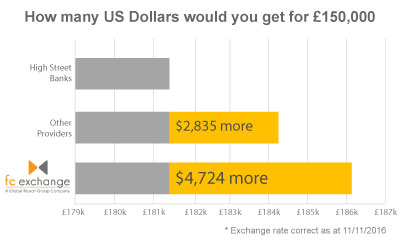

Clients can benefit from competitive exchange rates up to 4% better than banks and other currency providers. FC Exchange offers a Best Exchange Rate Guarantee for peace of mind. - A Specialist Dedicated to Saving Clients Money

FC exchange puts its clients first and establishes each customer with an experienced account manager to help them navigate the currency transfer process with tailored services that can maximize their funds. - Transparent Trading

The amount quoted is exactly what a client pays; no hidden fees or tagged on commission to weigh down currency transfers. Clients can save up to $50 per international money transfer in fees alone. - Making Currency Work for the Individual

Rather than offering generic services, FC Exchange takes time to get to know every client’s needs. FC Exchange can create a bespoke currency trade tailored for an individual’s exact requirements, and ensure clients get the most dollars for their money. They can even secure customers a favorable rate today that can be used at any point in the next two years to save them thousands in massive market shifts. - Keeping Clients Updated

Clients don’t need to spend hours monitoring the currency market with FC Exchange’s regular reports highlighting the most significant events. If a chosen currency pair begins to make noticeable movement, FC Exchange can get in touch with their client immediately. Thus, making sure a favorable exchange rate doesn’t slip past their notice.

Top Questions About Transferring Your Currency Into U.S. Dollars

[accordions id=”1255″]